March 22’s Wall Street Journal predicts challenging times for condo developers. The supply of condos currently exceeds 10 months of sales, the highest level since the National Association of Realtors began keeping records in 1999. Delinquency rates for condo loans held by commercial banks ballooned from 5.9% in the third quarter of 2007 to 10.1% in the fourth quarter, higher than the rates for single-family homes (7.5%), commercial buildings (2.2%) or apartment buildings (1.5%).

Woes in Condo Market Build As New Supply Floods Cities

The condominium market is about to get worse as many cities brace for a flood of new supply this year — the result of construction started at the height of the housing boom…

The deluge means bad news for developers and potentially lower prices…

The deteriorating economy isn’t helping. “When the world goes to hell in a handbasket, the last thing anyone wants to buy is a condo,” says Cathy Schlegel, a mortgage-loan broker in Fort Worth, Texas…

The rising supply is a reflection of the picture in 2004 through 2006 — a time of huge demand for condos. Speculation was rampant as investors believed empty nesters and young professionals seeking an urban experience akin to what they watched on “Friends” would prop up the condo market for years…

However, cancellations are rising, meaning developers may not be able to pay back their banks…

One option for a developer is to convert the condos to apartments. However, these projects are usually financed with the presumption that sales of individual condos pay off more than rents from a comparably sized apartment building. Also, lenders typically expect developers to pay off condo construction loans with the millions of dollars they receive when closing on the sales. Such a quick payout isn’t possible if the developer is only receiving monthly rental payments…

A project called ATLofts at the mammoth Atlantic Station project in downtown Atlanta presold about 80% of its 303 units in a mixed-use building that had condos above retail space. But the project ran into water-infiltration problems. That gave buyers an out.

The developer, Lane Co., ended up turning about half the units into rentals…

See also:

Bloomberg: “S&P/Case-Shiller Home Prices Fell 9.1% in December” (2/26/08)

“It’s

inevitable that prices will decline a lot more in 2008 because

inventory is so high,” said Patrick Newport, an economist at Global

Insight Inc. in Lexington, Massachusetts…

Gazette: “Contractors assess extent of slowdown, as some projects lag” (2/18/08)

For

the first time in recent memory, Northampton city planners do not

expect to have a permit application for a residential or commercial

project before them, when they meet later this month.

Gazette: “North King Street condominium project stalls” (1/26/08)

James

M. Harrity Jr., of Northampton, has put 46 acres off North King Street

on the market for $2.4 million. The listing comes one year after the

Planning Board granted Harrity’s firm, Equity Builders Realty LLC, a

special permit to build 88 condominiums on about 10 acres of the

property as part of a cluster development.

“The market conditions are very tough right now,” said Harrity…

Republican: Florence condo units sold at half-price (12/4/07)

Tropical Storm Floyd Flood Damage Report (1999)

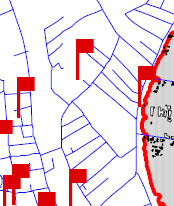

In the map below, the red flag behind View Avenue (the topmost

flag) indicates a flood damage report from Tropical Storm Floyd (1999).

This area is in the eastern portion of Kohl Construction’s proposed condo site, one of the more elevated portions. We infer that much of Kohl’s property may be at risk from heavy rainfall events.